how we achieve results

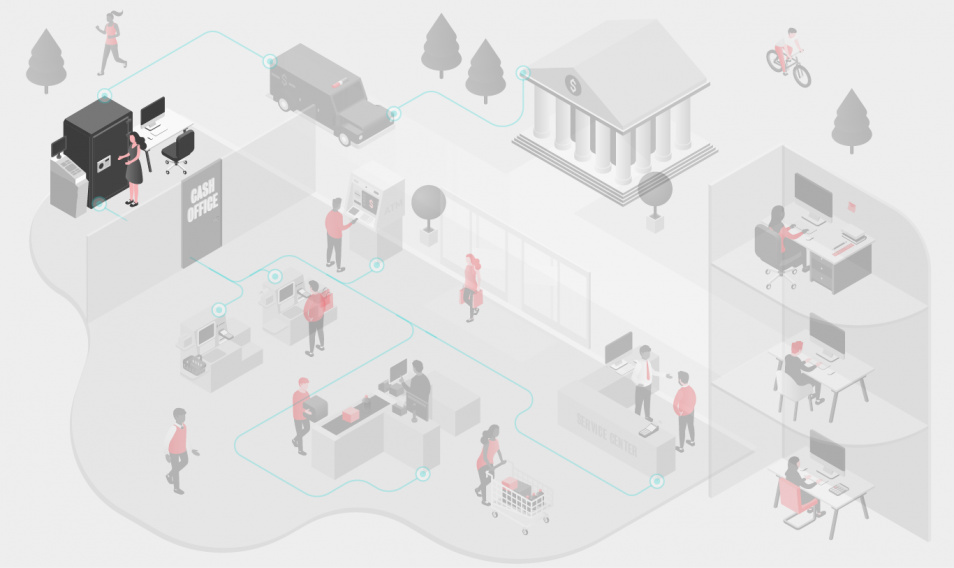

Transforming Your Entire Cash Ecosystem

When most organizations think about improving their cash management practices, they naturally focus on the Cash Office first. As the heart of cash operations, making the right changes where cash is dispensed, counted and reconciled can of course reap big rewards.

At Deposita, we take the viewfinder a little wider.

Our solution sees the Cash Office truly transformed. But by linking processes and systems, by applying years of collective on-the-ground experience and, importantly, by ensuring detailed data capture, we then leverage our proprietary tools, algorithms and expertise to drive benefits throughout your entire cash ecosystem. For very little extra effort on your team’s part, the benefits can be revolutionary.

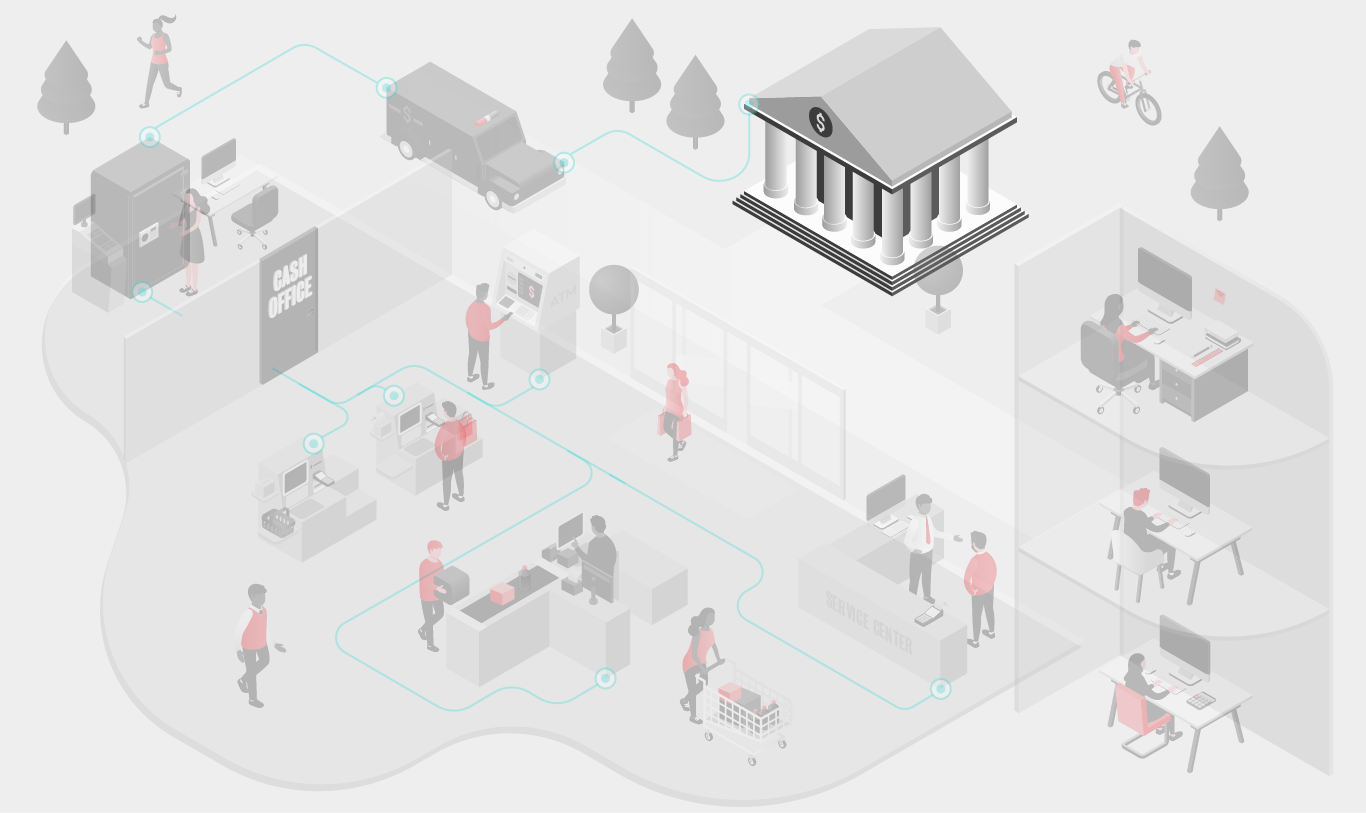

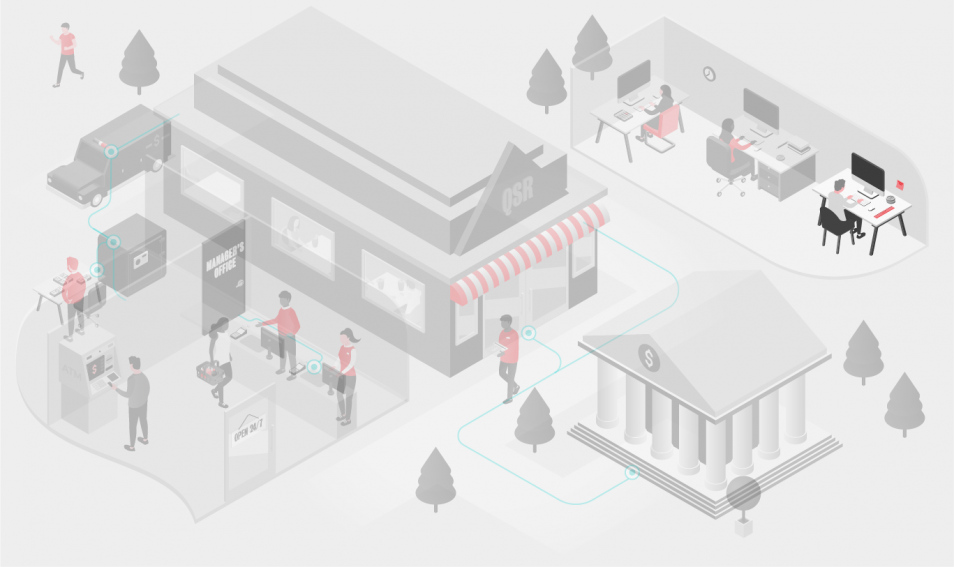

Select the image below that best matches your store operations. Then click on the icons to find out more about how Deposita can help transform every part of your end-to-end cash management practices.

-

Store Front-End

Our integrated solutions optimize how cash flows to and from your store front-end. Our expert team leverages years of retail experience together with process transformation and change management skills to build a solution that best suits your stores’ needs. With best-in-class technology and sophisticated forecasting, we ensure every one of your registers has the exact cash needed to meet your operational needs; by till and by denomination, every single day of the year. Integrating your POS and/or SCOs into our proprietary cash management platform, KOYUS®, takes visibility, control and automation to the next level, with reconciliation at the store then truly digitalized.

The Deposita Impact

- Reduction in time spent on cash handling tasks, freeing store associates to focus on your customers’ experience

- Automated reconciliation across the entire store

- Till mixes that meet your actual operational needs

- Reduced need for cash advances and skims

- Reduction in volume of cash on the shop floor, reducing working capital, risk and exposure to loss

- Greater visibility and control, with accountability down to the associate and/or lane

-

Cash Office

Working with Deposita, your cash office is truly transformed. At the center of our solutions are cash handling devices, such as a cash recycler or smart safe, selected to meet your stores’ individual needs. This facilitates the automation of counting, dispensing and basic accounting, while also improving safety and accountability. Where our solutions differ from others is that data from the device is then fed into our proprietary cash management platform, KOYUS®, which can also integrate with your systems such as POS, SCOs and other operational systems. KOYUS then streamlines your balancing processes and drives sophisticated cash forecasting to make sure you have the exact cash you need, down to the till and denomination level, day after day. With self service reporting, risk alerts and options for Deposita to also manage your change orders and CIT services, your team’s time is freed to focus on what truly matters most: your customers.

The Deposita Impact

- Reduction in the number of hours needed to perform cash management tasks

- Reduction in cash overages/shortages due to digitalized reconciliation

- Optimized cash holdings at every denomination, every day of the year

- Reduced need for cash advances and skims

- Reduced manual data entry with systems integration, reducing errors and saving significant time

- Reduced opportunity for cash leakage

- 24 x 7 x 365 support for store teams via Deposita’s Customer Service Centers

-

Operations

We know managing store operations is a complex endeavor, involving a balancing act between often seemingly competing demands, such as the need to reduce labor costs while also improving the customer experience. Equally, we recognize that managing change at a store level, much less an estate level, is often complicated; requiring thoughtful design, attention to detail and a tailored approach. Our process transformation and change management experts have years of combined experience navigating such initiatives, collaborating with clients to help them get the most from their daily operations and their change programs. They offer hands on support to store Operations teams in designing and deploying these transitions. They also assist them in establishing effective oversight, leveraging our proprietary cash management platform, KOYUS®, which provides self-service reporting, analytics and alerting. Once a store is live, our Service Team is on hand 24/7/365 to provide any additional support needed.

The Deposita Impact

- Reduction in the number of hours needed to perform cash management tasks without impacting customer experience

- Reduced opportunity for cash leakage

- 24 x 7 x 365 support for stores and teams via Deposita’s Customer Service Centers

- Deep industry and functional expertise drives process recommendations and approach

- An end-to-end view ensures down stream impacts are understood and transitions are managed effectively

- A strong focus on change management ensures change impacts are identified and addressed collaboratively

- Proactive compliance monitoring due to increased accountability, alerting and reporting

- Easier root cause analysis due to detailed transaction capture and increased visibility

-

Treasury

Deposita’s strategic banking relationships allow us to not only offer same day credit, but a fully bank owned cash model, immediately benefiting your working capital. Transactional data from store-based activity is fed directly into our proprietary cash management platform, KOYUS®, which feeds banking systems and provides you with self-service reporting and alerting. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to make sure your stores have the exact cash, down to the till and denomination level, that they need. With options for G4S to also manage your change orders and CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

- Improved working capital as a result of optimized cash inventory

- Working capital improvement via a 'bank owned cash' model

- Improved operating cash flow as a result of same day credit

- Reduction in overall cash processing volumes due to optimized cash holdings

- Proactive compliance monitoring due to increased accountability and reporting

- Elimination of time spent creating manual change orders and anticipating seasonal fluctuations

- Improved CIT management including cost reduction through performance and schedule optimization

- Reduction in balancing exceptions via digitalized reconciliation

-

Asset Protection

Our end-to-end solutions reduce the risk for employees, customers, partners and cash across your entire cash ecosystem. Best-in-class cash handling devices, such as cash recyclers and smart safes, underpin our solutions, automatically reducing the accessibility to cash while also driving accountability and visibility. Where our solutions differ from others is that transactional data from store-based activity is fed directly into our proprietary cash management platform, KOYUS® , which has a Profit Protection module that provides you with self-service reporting and alerting, among other tools. Having detailed transaction data at your fingertips, that can be easily interrogated in real time, is a game changer.

The Deposita Impact

- Reduction in cash leakage

- Reduction in the risks for employees, customers, partners, and cash

- One-stop-shop for suspicious activity and events out of ‘normal’ parameters via KOYUS®

- Proactive compliance monitoring due to increased accountability, alerting and reporting

- Easier root cause analysis due to detailed transaction capture and increased visibility, down to the lane or associate level

- An expert team with real life experience to translate the technological ‘alarm bells’ into actionable context

Find out more about our solutions

Transform your Front End

- Store Front End

- Systems Integrations

- Cash Forecasting

- Service and Support

- Process Transformation

- Change Management

-

Technology

While cash is the primary input into our solution, data comes in a close second. Our team consists of developers, product managers, security specialists and data scientists, to name a few, with market-leading abilities in capturing, processing, protecting, interrogating and leveraging data to benefit our clients businesses. Central to this is working with our client’s technology teams to design, build and/or integrate processes and systems into our proprietary cash management platform, KOYUS®. Through KOYUS®, we apply advanced technology such as sophisticated algorithms, machine learning and artificial intelligence. Our strong relationships with other key technology players and cash handling device providers in the cash management industry ensure our ability to integrate and our focus on providing a true end-to-end solution is unrivaled.

The Deposita Impact

- An unrivaled cash management platform, in KOYUS®

- Rigorous data security practices and controls

- An established integration framework, with many industry leading providers of hardware and software already integrated

- An agnostic approach to determining which hardware or software solution best suits our client’s needs

- Aggressive investment in infrastructure to ensure security, reliability and scalability

- Collaborative expertise in designing, developing, deploying, leveraging and innovating technology-driven solutions.

-

Banking

Deposita realizes when it comes to choosing Banking services, one size does not fit all. Our close relationships with a wide array of Banking partners allow us to ensure you have the right support, whether it be at corporate level or at store level. These relationships also enable us not only offer same day credit, but a fully bank owned cash model. Transactional data from store-based activity is fed directly into our proprietary Cash Management Platform, KOYUS®, which automatically feeds banking systems and provides you with self-service reporting and alerting for visibility and control. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to make sure your stores have the exact cash, down to the till and denomination level, that they need, ultimately reducing your cash processing volumes. With options for Deposita to also manage change orders and CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

- Significant improvements to working capital with a 'bank owned cash' model

- Improved operating cash flow as a result of same day credit

- Reduction in overall cash processing volumes and cross shipping due to optimized cash holdings

- Greater integrity when reconciling bank accounts, driven from error proofed processes at the store level

- Easier root cause analysis due to detailed transaction capture and increased visibility

- One-stop-shop in the event support is needed

- Unique portfolio of banking partners, with solutions offered on a multi-bank basis

-

CIT Providers

Our solutions offer you the option to have Deposita manage your change orders and/or CIT relationship. We leverage our automated tools to track each visit through to successful completion, taking immediate remedial action if needed. If a pick up is missed, our team ensure that is recovered. If a change order delivery is missed or incomplete, our team will investigate and ensure your store have sufficient funds to maintain operations. With active communications from our teams, along with self service reporting and analytics, your team retain visibility and control without having the burden of day-to-day administration and exceptions management.

Where clients choose to retain ownership, we support them with detailed analysis and recommendations on how to get the most from the service provided, including optimizing time on premise, days of service and frequency of service. With transactional data fed directly into our proprietary cash management platform, KOYUS®, managing providers against SLA has never been easier.

The Deposita Impact

- Reduction in cost associated with CIT services via optimizing days and frequency of service

- Support from Deposita’s dedicated Carrier Management Team in managing day-to-day service from CIT providers

- Easier to manage CIT providers to SLAs via detailed performance data

- Proactive support for missed visits and/or change orders via Deposita’s alerting capability

- Easier root cause analysis due to detailed transaction capture, supporting effective corrective action plans where needed

-

Cash Handling Devices

Deposita knows that when it comes to choosing cash handling devices such as cash recyclers, one size does not fit all. Our close relationships with a wide array of cash handling device providers allows us to ensure you have access to the best options in the market, and that we can assist you in selecting the right equipment for maximum impact at store level while achieving the best return on your investment. Our proprietary cash management platform, KOYUS®, integrates with POS systems, recyclers, safes, SCOs and scanners, automatically feeding data to necessary systems and providing you with service reporting and alerting for visibility and control. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to drive optimized cash holdings, auxiliary services (such as change orders and CIT services) and process efficiency.

Hardware alone will get you so far. Deposita’s solution drives inefficiencies from your ENTIRE cash ecosystem to help you maximize your return on investment, often with little additional effort on your team’s part.

The Deposita Impact

- Impartial, agnostic approach to selecting the right hardware for your needs

- A focus on your entire cash ecosystem

- Collaborative approach to addressing people, process AND technology

- Deep expertise on integrations and end-to-end automation

- Thought leadership on tools such as as machine learning and AI

- A forward thinking, innovative culture, to help you stay ahead

-

Store Front-End

Keeping your employees, customers, partners and cash safe is at the core of most smart safe programs. At Deposita, we take that much further. Our expert team leverages years of retail experience together with process transformation and change management skills to build an efficient solution that best suits your locations’ needs while saving you cost. With best-in-class technology and sophisticated cash forecasting capabilities, we can ensure your team has the exact cash needed to meet your operational needs. Importantly, through our proprietary cash management platform, KOYUS®, we give you the visibility and control you need to take your cash management practices to the next level.

The Deposita Impact

- Reduction in time spent on cash management tasks

- Reduction in volume of cash at your front-end, reducing working capital, risk and cash leakage

- Greater visibility and control, with accountability down to the employee

- Reduction in the risks for employees, customers, partners, and cash

- More time to focus on your customer experience and ultimately, your profits.

-

Cash Office

Working with Deposita, your cash “office” is truly transformed. At the center of our solutions are cash handling devices, such as a smart safe, selected to meet your locations’ specific needs. This facilitates the automation of counting, dispensing (if needed) and basic accounting, while also improving safety and accountability. Where our solutions differ from others is how we leverage data and technology to simplify your wider cash management practices. By leveraging our market leading cash management platform, KOYUS®, your team can prepare, capture, exchange custody and research deposits as well as place, track and receive change orders, all at the touch of a button. KOYUS® can also integrate with your systems such as POS, to streamline your balancing processes. With self service reporting, risk alerts and options for Deposita to also manage your CIT services, your team’s time is freed to focus on what truly matters most.

The Deposita Impact

- Reduction in the number of hours needed to perform cash management tasks

- Reduction in cash overages/shortages due to more accurate counting and data capture facilitated via KOYUS®

- Improved deposit tracking via KOYUS®

- Simplified change order placement, tracking, receipt and management via KOYUS®

- Reduced need for cash accounting investigations due to increased accountability, visibility and controls

- With systems integration, digitalization of your reconciliation process, reducing errors and saving significant time

- Reduction in the risks for employees, customers, partners, and cash

- 24 x 7 x 365 support for store teams via Deposita’s Customer Service Centers

-

Walking to the Bank

For those locations that have historically ‘walked’ their cash deposits to their local bank, to physically make a deposit into their bank account and pick up change orders, there has been additional risk to both employees and cash layered on top of the usual concerns of managing cash. With Deposita’s solution, this need is removed entirely. We use data to determine the best CIT provider to meet your individual locations’ needs, working with you to manage the relationship in the manner that best suits your business needs. By leveraging our Electronic Cash Automation and Tracking System, eCATS, your team can prepare, capture, exchange custody and research deposits as well as place, track and receive change orders, all at the touch of a button. Not only does this reduce your exposure to risk but it frees your team members valuable time for more value adding tasks.

The Deposita Impact

- Release the time associated with “walking” cash deposits to a bank

- Improved deposit tracking via KOYUS®

- Reduction in the risk for employees

- Reduced opportunity for cash leakage

-

Finance

Deposita simplifies and error proofs your accounting tasks. Our strategic banking relationships can also provide you with same day credit, giving you faster access to your cash. Transactional data from activity at your locations is fed directly into our proprietary cash management platform, KOYUS®, which feeds banking systems to facilitate this while also providing you with self-service reporting and alerting. Through our automated change ordering module in KOYUS®, your team can prepare, capture, exchange custody and research deposits as well as place, track and receive change orders, all at the touch of a button. KOYUS® can also support you in optimizing your reconciliation processes and cash holdings (link to ‘Inventory Management’ page). With options for G4S to also manage your CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

- Improved operating cash flow as a result of same day credit

- Elimination of time spent creating manual change orders and anticipating seasonal fluctuations

- Optimized reconciliation via KOYUS®

- Reduction in overall cash processing volumes due to reduced banking deposits and optimized cash holdings, improving working capital

- Proactive compliance monitoring due to increased accountability and reporting

- Improved CIT management including cost reduction through performance and schedule optimization

-

Operations

We know managing operations is a complex endeavor, involving a balancing act between often seemingly competing demands, such as the need to control operating expenses while also competing in a crowded marketplace. Equally, we recognize that managing change at a store level, much less an estate level, is often complicated; requiring thoughtful design, attention to detail and a tailored approach. Our process transformation and change management experts have years of combined experience navigating such initiatives, collaborating with clients to help them get the most from their daily operations and their change programs. They offer hands on support to store Operations teams in designing and deploying these transitions. They also assist them in establishing effective oversight, leveraging our proprietary cash management platform, KOYUS®, which provides self-service reporting, analytics and alerting. Once a store is live, our Service Team is on hand 24/7/365 to provide any additional support needed.

The Deposita Impact

- Reduction in the number of hours needed to perform cash management tasks without impacting customer experience

- Reduced opportunity for cash leakage

- 24 x 7 x 365 support for stores and teams via Deposita’s Customer Service Centers

- Deep functional expertise drives process recommendations and approach

- An end-to-end view ensures down stream impacts are understood and transitions are managed effectively

- A strong focus on change management ensures change impacts are identified and addressed collaboratively

- Proactive compliance monitoring due to increased accountability, alerting and reporting

- Easier root cause analysis due to detailed transaction capture and increased visibility

-

Asset Protection

Our end-to-end solutions reduce the risk for employees, customers, partners and cash across your entire cash ecosystem. Best-in-class cash handling devices, such as a smart safe, underpin our solutions, automatically reducing the accessibility to cash while also driving accountability and visibility. Where our solutions differ from others is that transactional data from store-based activity is fed directly into our proprietary cash management platform, KOYUS® , which has a Profit Protection module that provides you with self-service reporting and alerting, among other tools. Having detailed transaction data at your fingertips, that can be easily interrogated in real time, is a game changer.

The Deposita Impact

- Reduction in cash leakage

- Reduction in the risks for employees, customers and partners

- One-stop-shop for suspicious activity and events out of ‘normal’ parameters via KOYUS®

- Proactive compliance monitoring due to increased accountability, alerting and reporting

- Easier root cause analysis due to detailed transaction capture and increased visibility, down to the lane or cashier level

- An expert team with real life experience to translate the technological ‘alarm bells’ into actionable context

-

Technology

While cash is the primary input into our solution, data comes in a close second. Our team consists of developers, product managers, security specialists and data scientists, to name a few, with market-leading abilities in capturing, processing, protecting, interrogating and leveraging data to benefit our clients businesses. Central to this is working with our client’s technology teams to design, build and/or integrate processes and systems into our proprietary cash management platform, KOYUS®. Through KOYUS®, we apply advanced technology such as s sophisticated algorithms, machine learning and artificial intelligence. Our strong relationships with other key technology players and cash handling device providers in the cash management industry ensure our ability to integrate and focus on providing a true end-to-end solution is unrivaled.

The Deposita Impact

- An unrivaled cash management platform, in KOYUS®

- KOYUS® supports change order and deposit management and reconciliation

- Rigorous data security practices and controls

- An established integration framework, with many industry leading providers of hardware and software already integrated

- An agnostic approach to determining which hardware or software solution best suits our client’s needs

- Aggressive investment in infrastructure to ensure security, reliability and scalability

- Collaborative expertise in designing, developing, deploying, leveraging and innovating technology-driven solutions.

-

Banking

Deposita realizes when it comes to choosing Banking services, one size does not fit all. Our close relationships with a wide array of Banking partners allow us to ensure you have the right support, whether it be at corporate level or at location level. These relationships also enable us to offer same day credit. Transactional data from activity at a location is fed directly into our proprietary Cash Management Platform, KOYUS® , which automatically feeds banking systems and provides you with self-service reporting and alerting for visibility and control. Moreover, our solution helps you to optimize cash holdings, ultimately reducing your cash processing volumes. With options for Deposita to also manage change orders and CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

- Improved operating cash flow as a result of same day credit

- Unique portfolio of banking partners with solutions offered on a multi-bank basis

- Reduction in overall cash processing volumes due to optimized cash holdings

- Easier root cause analysis due to detailed transaction capture and increased visibility

- One-stop-shop in the event support is needed

-

CIT Providers

Our solutions offer you the option to have Deposita manage your CIT relationship. We leverage our automated tools to track each visit through to successful completion, taking immediate remedial action if needed. If a pick up is missed, our team ensure that is recovered. If a change order delivery is missed or incomplete, our team will investigate and ensure your location has sufficient funds to maintain operations. With active communications from our teams, along with self service reporting and analytics, your team retain visibility and control without having the burden of day-to-day administration and exceptions management.

Where clients choose to retain ownership, we support them with detailed analysis and recommendations on how to get the most from the service provided, including optimizing time on premise, days of service and frequency of service. With transactional data fed directly into our proprietary cash management platform, KOYUS®, managing providers against SLA has never been easier.

The Deposita Impact

- Reduction in cost associated with CIT services via optimizing days and frequency of service

- Support from Deposita’s dedicated Carrier Management Team in managing day-to-day service from CIT providers

- Improved deposit tracking via KOYUS®

- Easier to manage CIT providers to SLAs via detailed performance data

- Proactive support for missed visits and/or change orders via Deposita’s alerting capability

- Easier root cause analysis due to detailed transaction capture and increased visibility

-

Cash Handling Devices

Deposita knows that when it comes to choosing cash handling devices such as smart safes, one size does not fit all. Our close relationships with a wide array of cash handling device providers allows us to ensure you have access to the best options in the market, and that we can assist you in selecting the right equipment for maximum impact at location level while achieving the best return on your investment. Our proprietary cash management platform, KOYUS®, integrates with POS systems, recyclers, safes, SCOs and scanners, automatically feeding data to necessary systems and providing you with service reporting and alerting for visibility and control. Moreover, where data is available, KOYUS® leverages machine learning and sophisticated algorithms to drive optimized cash holdings, auxiliary services (such as change orders and CIT services) and process efficiency.

Hardware alone will get you so far. Deposita’s solution drives inefficiencies from your ENTIRE cash ecosystem to help you maximize your return on investment, often with little additional effort on your team’s part.

The Deposita Impact

- Impartial, agnostic approach to selecting the right hardware for your needs

- A focus on your entire cash ecosystem

- Collaborative approach to addressing people, process AND technology

- Deep expertise on integrations and end-to-end automation

- Thought leadership on tools such as as machine learning and artificial intelligence

- A forward thinking, innovative culture, to help you stay ahead.

Large Retail Format

Cash Office

Working with Deposita, your cash office is truly transformed. At the center of our solution is cash management hardware, such as a cash recycler or smart safe, selected to meet your stores’ individual needs. This facilitates the automation of counting, dispensing and basic accounting, while also improving safety and accountability. Where our solution differs from others is that data from the device is then fed into our proprietary cash management platform, KOYUS®, which can also integrate with your systems such as POS, SCOs and other operational systems. KOYUS then streamlines your balancing processes and drives sophisticated cash forecasting to make sure you have the exact cash you need, down to the till and denomination level, day after day. With self service reporting, risk alerts and options for Deposita to also manage your change orders and CIT services, your team’s time is freed to focus on what truly matters most: your customers.

The Deposita Impact

Reduction in the number of hours needed to perform cash management tasks

Reduction in cash overages/shortages due to more accurate counting and data capture

Optimized cash holdings at every denomination, every day of the year

Reduced need for cash accounting investigations due to increased accountability, visibility and controls

With systems integration, digitalization of your entire reconciliation process, reducing errors and saving significant time

Reduction in the risks for employees, customers, partners, and cash

Banking

Deposita realizes when it comes to choosing Banking services, one size does not fit all. Our close relationships with a wide array of Banking partners allow us to ensure you have the right support, whether it be at corporate level or at store level. These relationships also enable us not only offer same day credit, but a fully bank owned cash model. Transactional data from store-based activity is fed directly into our proprietary Cash Management Platform, KOYUS®, which automatically feeds banking systems and provides you with self-service reporting and alerting for visibility and control. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to make sure your stores have the exact cash, down to the till and denomination level, that they need, ultimately reducing your cash processing volumes. With options for Deposita to also manage change orders and CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

Cash added faster to the balance sheet via same day credit

Reduction in overall cash processing volumes and cross shipping due to optimized cash holdings

Significant improvements to working capital with a Bank owned cash model and optimized cash holdings

Greater integrity when reconciling bank accounts, driven from error proofed processes at the store level

Easier root cause analysis due to detailed transaction capture and increased visibility

One-stop-shop in the event support is needed

CIT Providers

Our solution offers you the option to have Deposita manage your change orders and/or CIT relationship. We leverage our automated tools to track each visit through to successful completion, taking immediate remedial action if needed. If a pick up is missed, our team ensure that is recovered. If a change order delivery is missed or incomplete, our team will investigate and ensure your store have sufficient funds to maintain operations. With active communications from our teams, along with self service reporting and analytics, your team retain visibility and control without having the burden of day-to-day administration and exceptions management.

Where customers choose to retain ownership, we support them with detailed analysis and recommendations on how to get the most from the service provided, including optimizing time on premise, days of service and frequency of service. With transactional data fed directly into our proprietary cash management platform, KOYUS®, managing providers against SLA has never been easier.

The Deposita Impact

Support managing exceptions day-to-day from Deposita’s dedicated Carrier Management Team

Easier to manage CIT providers to SLAs via detailed performance data

Objective assessment of the best provider to meet your needs, case-by-case

Reduction in cost associated with CIT services via optimizing days and frequency of service

Reduced risk and interruption caused by CIT services at the store level

Easier root cause analysis due to detailed transaction capture and increased visibility

One-stop-shop in the event additional support is needed

Cash Recyclers

Deposita knows that when it comes to choosing cash handling devices, one size does not fit all. Our close relationships with a wide array of hardware providers allows us to ensure you have access to the best options in the market, and that we can assist you in selecting the right equipment for maximum impact at store level while achieving the best return on your investment. Our proprietary cash management platform, KOYUS®, integrates with cash recyclers as well as other systems and devices such as safes, POS, SCOs and scanners, automatically transferring data and providing you with service reporting and alerting for visibility and control. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to drive optimized cash holdings, auxiliary services (such as change orders and CIT services) and process efficiency.

Hardware alone will get you so far. Deposita’s solution drives inefficiencies from your ENTIRE cash ecosystem to help you maximize your return on investment, often with little additional effort on your team’s part.

The Deposita Impact

Impartial, agnostic approach to selecting the right hardware for your needs

A focus on your entire cash ecosystem

Collaborative approach to addressing people, process AND technology

Deep expertise on integrations and end-to-end automation

Thought leadership on tools such as as machine learning and AI

A forward thinking, innovative culture, to help you stay ahead

Store Front-End

Our integrated solution optimizes how cash flows to and from your store front end. Our expert team leverages years of retail experience together with process transformation and change management skills to build a solution that best suits your stores’ needs. With best-in-class technology and sophisticated forecasting, we ensure every one of your registers has the exact cash needed to meet your operational needs; by till and by denomination, every single day of the year. Integrating your POS and/or SCOs into our proprietary cash management platform, KOYUS®, takes visibility, control and automation to the next level, with reconciliation at the store then truly digitalized.

The Deposita Impact

Automated reconciliation across the entire store

Reduction in time needed to get cash to/from the front end

Smoother transition between shifts

Till mixes that meet your actual operational needs

Reduction in volume of cash on the shop floor, reducing working capital, risk and exposure to loss

Greater visibility and control

Greater focus on your customers’ experience

Shared Services

Deposita understands a fundamental tenant of managing cash effectively is being able to balance. That is why we have a dedicated team of experts focused on working with our customers to perfect reconciliation processes early in deployment. Transactional data from store-based activity is fed directly into our proprietary cash management platform, KOYUS® , which feeds banking systems and can be integrated into internal systems . By also integrating POS and SCOs, reconciliation can largely be digitalized. Error proofing at a store level, for example around change order acceptance and deposit preparation, helps to reduce the occurrence of errors of exceptions. Where balancing exceptions do occur, KOYUS® provides self-service reporting and alerting to make investigations as quick and as pain-free as possible.

The Deposita Impact

Proactive compliance monitoring due to increased accountability, alerting and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility

Reduction in time spent on reconciling bank accounts due to change order tracking and systems integration

Fewer reconciliation errors due to automation, systems integration and reduced manual data entry

One-stop-shop in the event support is needed to understand a balancing exception

Operations

We know managing changes at a store level is a complex endeavor, and one that will require thought, attention to detail and a tailored approach. Our process transformation and change management experts have years of combined experience navigating such initiatives, collaborating with customers to help them get the most from their change programs. They offer hands on support to store Operations teams in designing and deploying these transitions. They also assist them in establishing effective oversight, leveraging our proprietary Cash Management Platform, KOYUS®, which provides self-service reporting, analytics and alerting. Once a store is live, our Service Team is on hand 24/7/365 to provide any additional support needed.

The Deposita Impact

Deep functional expertise drives process recommendations and approach

An end-to-end view ensures down stream impacts are understood and transitions are managed effectively

A strong focus on change management ensures change impacts are identified and addressed collaboratively

Proactive compliance monitoring due to increased accountability, alerting and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility

One-stop-shop in the event support is needed

Reduction in the number of hours needed to perform cash management tasks across the entire cash ecosystem

Reduction in the risks for employees, customers, partners, and cash

Treasury

Deposita’s strategic Banking relationships allow us to not only offer same day credit, but a fully bank owned cash model, immediately benefiting your working capital. Transactional data from store-based activity is fed directly into our proprietary cash management platform, KOYUS®, which feeds banking systems and provides you with self-service reporting and alerting. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to make sure your stores have the exact cash, down to the till and denomination level, that they need. With options for G4S to also manage your change orders and CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

Reduced working capital via banked owned cash and optimizing cash holdings

Cash added faster to the balance sheet via same day credit

Reduction in overall cash processing volumes due to optimized cash holdings

Proactive compliance monitoring due to increased accountability and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility

Elimination of time spent on creating manual change orders and anticipating seasonal fluctuations

Transfer of all CIT exceptions management to the Deposita team

Reduction in cost and risk associated with CIT services via optimization

Asset Protection

Our end-to-end solution reduces risk for employees, customers, partners and cash across your entire cash ecosystem. Best-in-class hardware underpins the solution, automatically reducing the accessibility to cash while also driving accountability and visibility. Where our solution differs from others is that transactional data from store-based activity is fed directly into our proprietary cash management platform, KOYUS® , which has a Profit Protection module that provides you with self-service reporting and alerting, among other tools. Having detailed transaction data at your fingertips, that can be easily interrogated in real time, is a game changer.

The Deposita Impact

Reduction in the risks for employees, customers, partners, and cash

One-stop-shop for suspicious activity and events out of ‘normal’ parameters via our Profit Protection module

Proactive compliance monitoring due to increased accountability, alerting and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility, down to the lane or cashier level

An expert team with real life experience to translate the technological ‘alarm bells’ into actionable context

Technology

While cash is the primary input into our solution, data comes in a close second. Our team consists of developers, product managers, security specialists and data scientists, to name a few, with market-leading abilities in capturing, processing, protecting, interrogating and leveraging data to benefit our customers’ businesses. Central to this is working with our customer’s technology teams to design, build and/or integrate processes and systems into our proprietary cash management platform, KOYUS®. Furthermore, we have strong relationships with other key technology players and hardware providers in the cash management industry, to ensure our integration capabilities and focus on providing a true end-to-end solution is unrivaled.

The Deposita Impact

An unrivaled cash management platform, in KOYUS®

Rigorous data security practices and controls

An established integration framework, with many industry leading providers of hardware and software already integrated

An agnostic approach to determining which hardware or software solution best suits our customer’s needs

Aggressive investment in infrastructure to ensure security, reliability and scalability

Collaborative expertise in designing, developing, deploying, leveraging and innovating technology-driven solutions

Small Retail Format

Asset Protection

Our end-to-end solution reduces risk for employees, customers, partners and cash across your entire cash ecosystem. Best-in-class hardware, such as a Smart Safe, underpins the solution, automatically reducing the accessibility to cash while also driving accountability and visibility. Where our solution differs from others is that transactional data from activity at your locations is fed directly into our proprietary cash management platform, KOYUS®, which has a Profit Protection module that provides you with self-service reporting and alerting, among other tools. Having detailed transaction data at your fingertips, that can be easily interrogated in real time, is a game changer.

The Deposita Impact

Reduction in the risks for employees, customers, partners, and cash

One-stop-shop for suspicious activity and events out of ‘normal’ parameters via our Profit Protection module

Proactive compliance monitoring due to increased accountability, alerting and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility, down to the lane or cashier level

An expert team with real life experience to translate the technological ‘alarm bells’ into actionable context

Banking

Deposita realizes when it comes to choosing Banking services, one size does not fit all. Our close relationships with a wide array of Banking partners allow us to ensure you have the right support, whether it be at corporate level or at location level. These relationships also enable us to offer same day credit. Transactional data from activity at a location is fed directly into our proprietary Cash Management Platform, KOYUS® , which automatically feeds banking systems and provides you with self-service reporting and alerting for visibility and control. Moreover, our solution helps you to optimize cash holdings, ultimately reducing your cash processing volumes. With options for Deposita to also manage change orders and CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

Cash added faster to the balance sheet via same day credit

Reduction in overall cash processing volumes due to optimized cash holdings, also improving working capital

Easier root cause analysis due to detailed transaction capture and increased visibility

One-stop-shop in the event support is needed

CIT Providers

Our solution offers you the option to have Deposita manage your CIT relationship. We leverage our automated tools to track each visit through to successful completion, taking immediate remedial action if needed. If a pick up is missed, our team ensure that is recovered. If a change order delivery is missed or incomplete, our team will investigate and ensure your location has sufficient funds to maintain operations. With active communications from our teams, along with self service reporting and analytics, your team retain visibility and control without having the burden of day-to-day administration and exceptions management.

Where customers choose to retain ownership, we support them with detailed analysis and recommendations on how to get the most from the service provided, including optimizing time on premise, days of service and frequency of service. With transactional data fed directly into our proprietary cash management platforms, KOYUS® and eCATs, managing providers against SLA has never been easier.

The Deposita Impact

Improved deposit tracking via our electronic cash automation and tracking system, eCATS

Support managing exceptions day-to-day from Deposita’s dedicated Carrier Management Team

Easier to manage CIT providers to SLAs via detailed performance data

Objective assessment of the best provider to meet your needs, case-by-case

Reduction in cost associated with CIT services via optimizing days and frequency of service

Reduced risk and interruption caused by CIT services at the location level

Easier root cause analysis due to detailed transaction capture and increased visibility

One-stop-shop in the event additional support is needed

Store Front End

Keeping your employees, customers, partners and cash safe is at the core of most smart safe programs. At Deposita, we take that much further. Our expert team leverages years of retail experience together with process transformation and change management skills to build an efficient solution that best suits your locations’ needs while saving you cost. With best-in-class technology and sophisticated cash forecasting capabilities, we can ensure your team has the exact cash needed to meet your operational needs. Importantly, through our proprietary cash management platforms, KOYUS® and eCATS, we give you the visibility and control you need to take your cash management practices to the next level.

The Deposita Impact

Reduction in time needed to manage your cash

Automated change ordering via eCATs improves accuracy and visibility and saves your team time

Reduction in volume of cash at your front end, reducing working capital, risk and exposure to loss

Greater visibility and control

Reduction in the risks for employees, customers, partners, and cash

More time to focus on your customer experience and ultimately, your profits.

Cash Handling Devices

Deposita knows that when it comes to choosing cash handling devices, one size does not fit all. Our close relationships with a wide array of hardware providers allows us to ensure you have access to the best options in the market, and that we can assist you in selecting the right equipment for maximum impact at store level while achieving the best return on your investment. Our proprietary cash management platform, KOYUS®, integrates with cash recyclers and smart safes as well as other systems and devices such as POS, SCOs and scanners, automatically transferring data and providing you with service reporting and alerting for visibility and control. Moreover, KOYUS® leverages machine learning and sophisticated algorithms to drive optimized cash holdings, auxiliary services (such as change orders and CIT services) and process efficiency.

Hardware alone will get you so far. Deposita’s solution drives inefficiencies from your ENTIRE cash ecosystem to help you maximize your return on investment, often with little additional effort on your team’s part.

The Deposita Impact

Impartial approach to selecting the right hardware for your needs

A focus on your entire cash ecosystem

Collaborative approach to addressing people, process AND technology

Deep expertise on integrations and end-to-end automation

Thought leadership on tools such as as machine learning and AI

A forward thinking, innovative culture, to help you stay ahead.

Technology

While cash is the primary input into our solution, data comes in a close second. Our team consists of developers, product managers, security specialists and data scientists, to name a few, with market-leading abilities in capturing, processing, protecting, interrogating and leveraging data to benefit our customers’ businesses. Central to this is working with our customer’s technology teams to design, build and/or integrate processes and systems into our proprietary cash management platform, KOYUS®. Furthermore, we have strong relationships with other key technology players and hardware providers in the cash management industry, to ensure our integration capabilities and focus on providing a true end-to-end solution is unrivaled.

The Deposita Impact

An unrivaled cash management platform, in KOYUS®

Our electronic cash automation and tracking system, eCATS, supports change order and deposit management and reconciliation

Rigorous data security practices and controls

An established integration framework, with many industry leading providers of hardware and software already integrated

An agnostic approach to determining which hardware or software solution best suits our customer’s needs

Aggressive investment in infrastructure to ensure security, reliability and scalability

Collaborative expertise in designing, developing, deploying, leveraging and innovating technology-driven solutions.

Operations

We know managing changes at a location level is a complex endeavor, and one that will require thought, attention to detail and a tailored approach. Our process transformation and change management experts have years of combined experience navigating such initiatives, collaborating with customers to help them get the most from their change programs. They offer hands on support to Operations teams in designing and deploying these transitions. They also assist them in establishing effective oversight, leveraging our proprietary cash management platform, KOYUS® , which provides self-service reporting, analytics and alerting. Once a location is live, our Service Team is on hand 24/7/365 to provide any additional support needed.

The Deposita Impact

Deep functional expertise drives process recommendations and approach

An end-to-end view ensures down stream impacts are understood and transitions are managed effectively

A strong focus on change management ensures change impacts are identified and addressed collaboratively

Proactive compliance monitoring due to increased accountability, alerting and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility

One-stop-shop in the event support is needed

Reduction in the number of hours needed to perform cash management tasks across the entire cash ecosystem

Reduction in the risks for employees, customers, partners, and cash

Walking to the bank

For those locations that have historically ‘walked’ their cash deposits to their local bank, to physically make a deposit into their bank account and pick up change orders, there has been additional risk to both employees and cash layered on top of the usual concerns of managing cash. With Deposita’s solution, this need is removed entirely. We use data to determine the best CIT provider to meet your individual locations’ needs, working with you to manage the relationship in the manner that best suits your business needs. By leveraging our Electronic Cash Automation and Tracking System, eCATS, your team can prepare, capture, exchange custody and research deposits as well as place, track and receive change orders, all at the touch of a button. Not only does this reduce your exposure to risk but it frees your team members valuable time for more value adding tasks.

The Deposita Impact

Release the time associated with “walking” cash deposits to a bank

Improved deposit tracking via our electronic cash automation and tracking system, eCATS

Reduction in the risk for employees, and cash

Finance

Deposita simplifies and error proofs your accounting tasks. Our strategic Banking relationships can also provide you with same day credit, giving you faster access to your cash. Transactional data from activity at your locations is fed directly into our proprietary cash management platform, KOYUS®, which feeds banking systems to facilitate this while also providing you with self-service reporting and alerting. Through our automated change ordering system, eCATS, your team can prepare, capture, exchange custody and research deposits as well as place, track and receive change orders, all at the touch of a button. eCATS can also support you in optimizing your reconciliation processes and cash holdings (link to ‘Inventory Management’ page). With options for G4S to also manage your CIT services, your team’s time is freed to focus on making money, not managing money.

The Deposita Impact

Elimination of time spent creating manual change orders and anticipating seasonal fluctuations

Optimized reconciliation via our electronic cash automation and tracking system, eCATS

Cash added faster to the balance sheet via same day credit

Reduction in overall cash processing volumes due to optimized cash holdings, improving working capital

Proactive compliance monitoring due to increased accountability and reporting

Easier root cause analysis due to detailed transaction capture and increased visibility

Transfer of all CIT exceptions management to the Deposita team

Reduction in cost and risk associated with CIT services via reduced frequency of service

Cash Office

Working with Deposita, your cash “office” is truly transformed. At the center of our solution is cash management hardware, such as a smart safe, selected to meet your locations’ specific needs. This facilitates the automation of counting, dispensing (if needed) and basic accounting, while also improving safety and accountability. Where our solution differs from others is how we leverage data and technology to simplify your wider cash management practices. By leveraging our Electronic Cash Automation and Tracking System, eCATS, your team can prepare, capture, exchange custody and research deposits as well as place, track and receive change orders, all at the touch of a button. Our market leading cash management platform, KOYUS®, can also integrate with your systems such as POS, to streamline your balancing processes. With self service reporting, risk alerts and options for Deposita to also manage your CIT services, your team’s time is freed to focus on what truly matters most.

The Deposita Impact

Reduction in the number of hours needed to perform cash management tasks

Reduction in cash overages/shortages due to more accurate counting and data capture

Improved deposit tracking via our electronic cash automation and tracking system, eCATS

Simplified change order placement, tracking, receipt and management via eCATS

Optimized cash holdings, every day of the year

Reduced need for cash accounting investigations due to increased accountability, visibility and controls

With systems integration, digitalization of your reconciliation process, reducing errors and saving significant time

Reduction in the risks for employees, customers, partners, and cash.

Find Out More About Our Solutions

Ready to Connect?

We recognize every organization is unique. That’s why our approach is consultative and our solutions are tailored to meet your specific needs. Contact us today to explore how we can work together to achieve your goals.